MPI’s new survey – industry in the time of pandemic

The MPI association inaugurated a survey exploring the vision of the meetings industry in the near post-corona future. The results discussed below are based on 400 responses gathered thus far from a respondent pool of 55% planners and 41% suppliers.

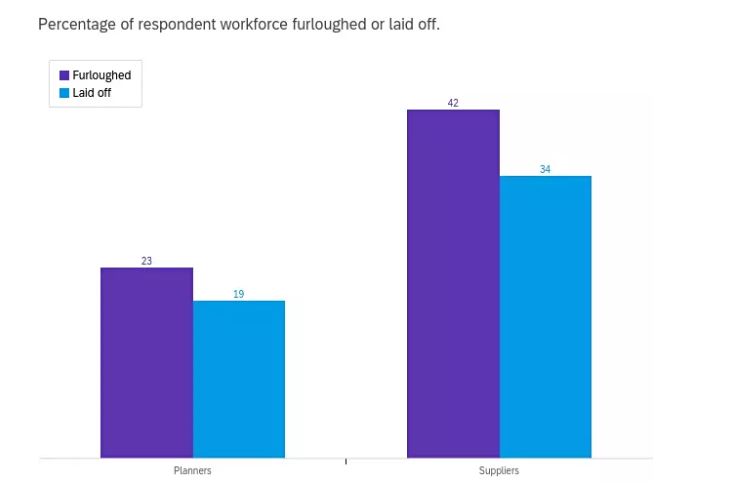

Current employment figures

Overall, respondents report 58% of the staff at their organizations have been either furloughed or laid off. Suppliers have been hit much harder with a total of 76% of staff affected - furloughed (42%) or laid off (34%). A slightly smaller impact was recorded among planners, with respondents indicating 23% of staff furloughed and 19% laid off.

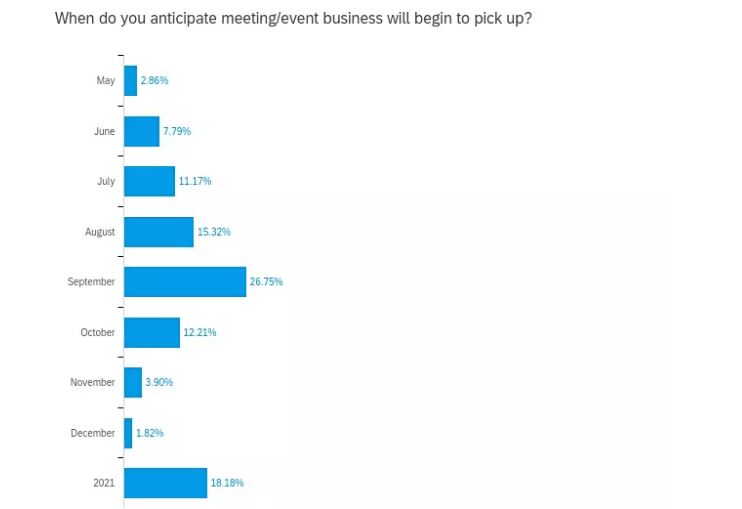

Industry recovery

Asking meeting professionals to predict when recovery will happen is a mixed bag of insight from currently booked business as well as a distillation of news and hope. That said, 42% of respondents expect business to start picking up again in August (15%) or September (27%). “Sometime in 2021” has also been picked as highly probable (18%).

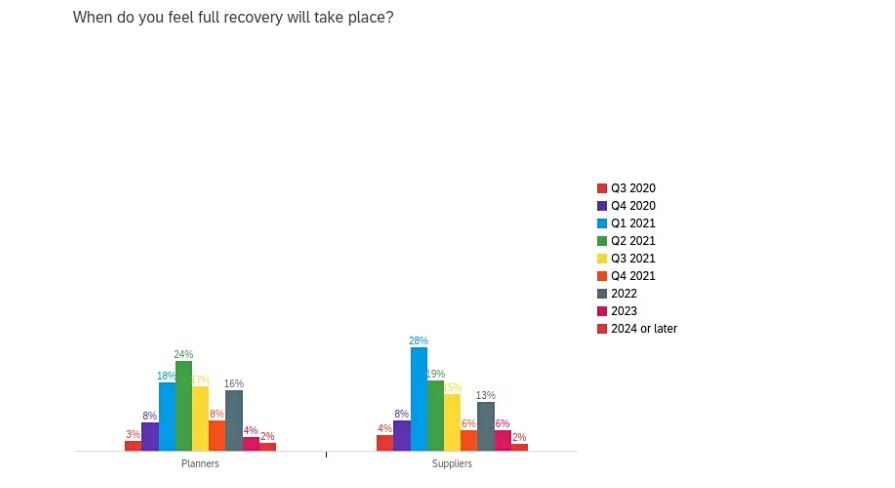

As for a timed target for full business recovery, most meeting professionals anticipate it in Q2 of 2021. In general, suppliers are expecting a slightly earlier recovery than planners, with 28% selecting Q1 of 2021.

The survey also referred to the buying process. Almost half of the surveyed planners (48%) indicate much longer buying windows. 50% of suppliers did not notice any changes compared to the pre-corona situation.

Changes to perception of destination/venue types

The survey results confirm that planners today focus their attention on local and regional destinations for hosting meetings.

Presented with 23 types of destinations and venues, planner respondents reported those about which they’ve had the most positive or the most negative change in perception. As many as 70% view “Online/Virtual” meetings in a more positive light than before the coronavirus pandemic, followed by “Shorter Distance from Home”. 86% view “Cruise Ships” in a more negative light than before, followed by “International” and “Asia-Pacific”.

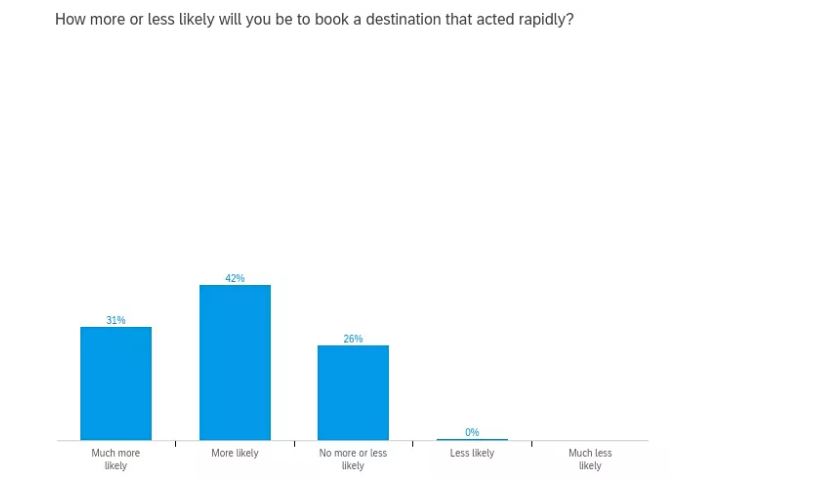

Planners’ perceptions of destinations have clearly been impacted by how the latter responded throughout the coronavirus pandemic, with 73% claiming a greater interest in the locations that quickly took appropriate measures.

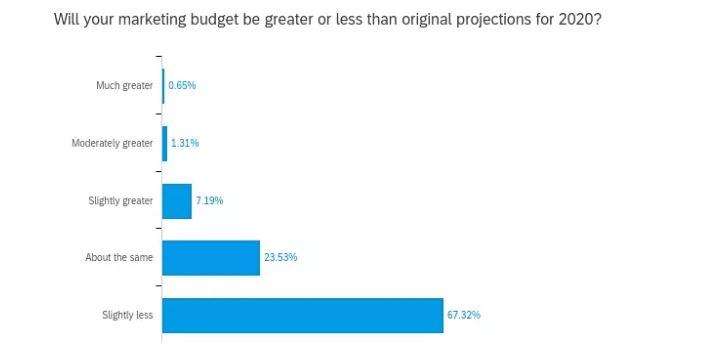

Based on the impact of the coronavirus, suppliers are expecting to realize only 45% of their originally projected revenue for 2020, with the majority of respondents also indicating smaller marketing budgets.

Source: www.mpi.org